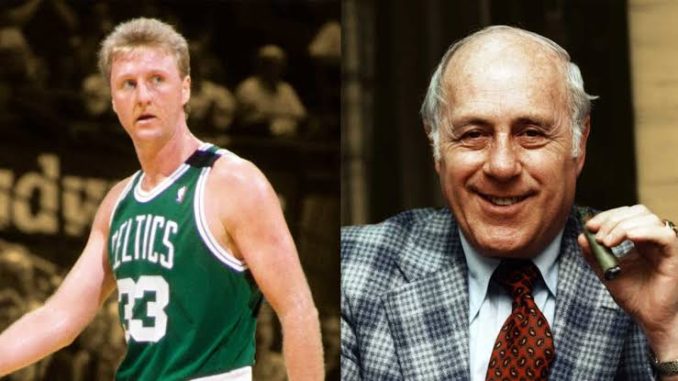

“He’s the greatest player ever to put on a uniform” – Red Auerbach explains why Larry Bird’s greatness required seeing beyond statistics.As a result, smaller card issuers may continue to charge a higher safe harbor threshold for credit card late fees and automatically increase the safe harbor dollar amount based on the Consumer Price Index. Note that under the final rule, if a smaller card issuer had fewer than one million open credit card accounts for the entire preceding calendar year but meets or exceeds that number of open credit card accounts in the current calendar year, the entity will no longer be a smaller card issuer as of 60 days after meeting or exceeding that number of open credit card accounts.

Highlights of the final rule

Lowering safe harbor dollaOn March 5, 2024, the Consumer Financial Protection Bureau (CFPB) issued a final rule amending provisions in Regulation Z that govern credit card late fee charges. The final rule follows the March 2023 release of the proposed rule related to credit card late fees and will take effect 60 days after publication in the Federal Register.

For credit card issuers with one million or more open accounts, together with their affiliates, the final rule:

Adjusts the safe harbor dollar amount for late fees from up to $41 to $8 and eliminates a higher safe harbor dollar amount for late fees for subsequent violations of the same type.

Requires larger card issuers that want to charge late fees above the $8 threshold to prove that the higher fee is necessary to cover actual costs (but clarifies post-charge off costs cannot be included in the costs analysis).Limits a larger card issuer’s ability to implement annual inflation adjustments for the safe harbor dollar amounts in connection with the late fee safe harbor amount. The CFPB instead will “monitor the market” and make adjustments to the safe harbor amount as necessary.

The CFPB expects that the new $8 safe harbor amount will apply to the largest 30 to 35 credit card issuers, covering more than 95% of the total outstanding balances in the credit card market as of the end of 2022.

Who does the rule cover?

The final rule establishes different requirements for credit card issuers based on the number of accounts held by issuers and their affiliates. In supplementary information accompanying the final rule, the CFPB indicates that applying the rule to smaller card issuers would result in a “heightened compliance burden.” According to a statement issued by CFPB Director Rohit Chopra, the CFPB “did not find evidence [that] these smaller companies are employing the fee churning business model, and in fact they generally charge much lower fees overall.”

Leave a Reply